Brief on CKYC Process

- Central KYC Registry is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector with an objective to reduce the burden of producing KYC documents and getting those verified every time when the customer creates a new relationship with a financial entity.

- We as Kairee group have been working in the DMS domain for more than 14 years having scanned more than a billion documents till date and continue to scan around 1 million documents per day across our various office located in multiple states.

Features of C-KYC

- User friendly web portal

- Unique KYC identifier linked with independent ID proofs

- KYC data and documents stored in a digitally secure electronic format

- Secure and advanced user authentication mechanisms for system access

- Data de-duplication to ensure single KYC identifier per applicant

- ID authentication with issuing authorities like Aadhaar/PAN etc.

- Substantial cost reduction by avoiding multiplicity of registration and data upkeep

- Real time notification to institutions on updation in KYC details

- Regulatory reports to monitor compliance

Flow Chart

Process

a) Receipt / Inward of Application Forms:

Physical copy of application forms are received.

- Once the application form received at back office, inward would be done on the basics of application number.

b) Scanning of Documents:

Received forms are scanned one by one through the system.

- Scanning of application form along with supporting documents.

- If barcode present on the application form, it can be read and the application form will have

the barcode value as name.

- Scanned images will be displayed to the user in a viewer at the left of the screen.

- User can navigate through the pages and view them.

- If required user can re-scan the application form.

- User will enter required details for the form, in the fields provided at the right side of the screen.

- These paper will be scanned and saved as PDF/ TIF

- The scan copy will be in encrypted format and will not able to read/ view the document.

c) Indexing of Documents:

a. Manual process

- Based on the index parameters, user can index the document manually (for e.g. title number, application number, applicant name, type of application etc.)

b. Automated process

- If the template of the forms are unique, we can define the zones where the indexing parameter are mentioned

- On the basis of zone OCR we can automate the process of capturing the index values based on OCR

- If the template doesn’t recognize OCR values, it will automatically move to manual index part.

d) Quality Check of scanned and indexed documents:

- We can create the profile and give certain access for quality check of images. Images which are not up to the mark can be replaced by new images

- In index parameters, user can edit or rename the appropriate index values base on the documents.

e) Retrieval of documents:

- Users will be logging into the web application to Search the document

- User can search by cabinet (Cabinets) (As per Index)

- On searching by required fields, the image will be showed in the Viewer

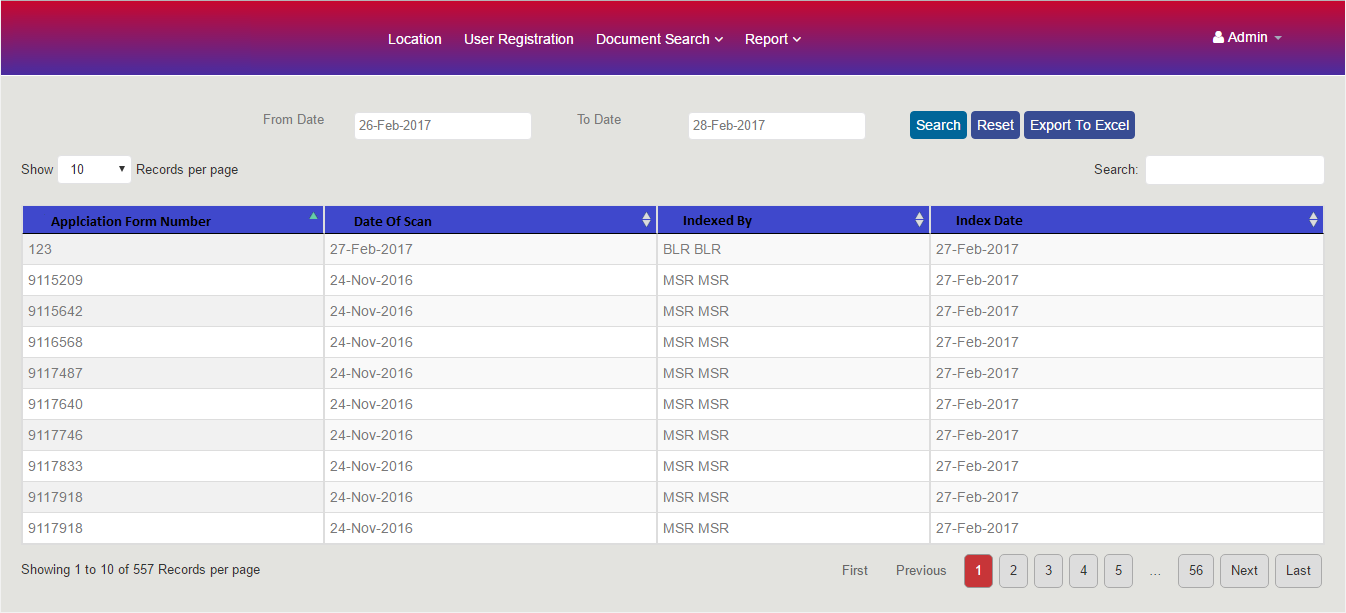

f) Reports

- MIS reports for analysis purpose.

- As per hierarchy, reports can be generated.

- These reports can be exported in to excel for further analysis

- Reports will be

- Report of number of scanned applications.

- Daily

- Weekly

- Monthly

g) A few of our clients in this domain are-

- Janata Sahakari Bank, Pune

- Janata Sahakari Bank – NDSL services

- The Ahmednagar Merchant Co-operative Bank

- The Kalupur Co-op Bank – Ahmedabad

- Vishweshwar Sahakari Bank

- Solapur Janata Sahakari Bank

- Wai Urban Co-op Bank

- Lonavala Sahakari Bank